Here you are — like 76% of your fellow Americans you’re living paycheck to paycheck and sometimes your pay doesn’t stretch that far. You also happen to be one of 44 million Americans who have unpaid student loans. Thanks to those loans, you managed to get a college degree, but it’s costing you $400 a month to keep from defaulting. Aren’t you glad, as former President Obama reminded you in his farewell address, that he’s “greased the runway” for you with the 11 million jobs he created. Unfortunately, like all, politicians particularly those on their way out the door he omitted a few details—like of those 11 million jobs, 10 ½ million (95%) are part time, minimum wage, benefit-free, in a word, contingent. And you’ve got one of them. You’re barely making it when a couple of unexpected emergencies upend your marginal existence. A brake job on the car that takes you to work at Starbucks, higher than expected utility bills, vet visit for Lucy, your cat, and a drop in the number of hours you’re scheduled to work. You’ve got one thing going for you— you’re not one of the 70 million Americans who are “unbanked.” (no account at a bank or credit union) You have a checking account, but like 60 million other Americans you are “underbanked.” The $80.70 you currently have in your checking account disqualifies you from getting a bank loan. Even if you did qualify, you’d be hard-pressed to find a bank. Between 2008-2013, traditional banks closed 20,000 branches including the three or four that used to be in your neighborhood. Who stepped in to fill the void? That’s right, pay day lenders with their high interest, short term loans. No longer hiding in back alleys, pay day lenders are a main street hit. You’re in for a shock when you stop in at your neighborhood store—super-high interest rates, short (2-week) repayment period, fees more inscrutable than those on your cell phone bill. It’s not as incomprehensible as it seems, rather it makes perfect sense in the crooked world of debt bondage: “…the …financial crisis has resulted in a growing ‘New Middle Class’ with little or no savings, urgent credit needs, and limited options.” (on-line pay day lender Elevate Credit —as good as their word, interest on their short-term loans average 600% APR)

That’s the dilemma facing 19 million Americans who become pay day borrowers every year, the majority living on less than $30,000 annually. With limited financial resources, where can they go when they don’t have the money for the rent or the electric bill, or their kid’s school trip. Banks loans are out of their reach and pay day is two weeks away? Only one option left — the shadowy world of what liberals are fond of calling “alternate banking services.” There’s nothing alternate about these pay day crooks. They’re as mainstream as Bank of America or Wells Fargo. The difference? “When the banks say no, we say yes.” [For a price].

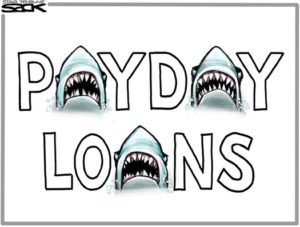

In the twentieth century, they were called, appropriately, loan sharks. In the 21st they have acquired a patina of respectability in the usual way — swelling the piggy banks of major federal and state politicians. A notorious example — Rep. Debbie Wasserman Schultz (D-FL), disgraced ex-head of the DNC (Democratic National Committee) who has received $68,000 from pay day lenders. On the theory that one good turn deserves another, she is co-sponsoring a Republican bill to postpone for at least 2 years, a modest attempt by the Consumer Financial Protection Bureau (CFBP), the federal consumer protection agency, to rein in the industry.

The process of separating people from money they don’t have is a devious one. Mehrsa Boradaran, a law professor and author of How the Other Half Banks, notes “One of the great ironies in modern America is that the less money you have, the more you pay to use it.” That’s precisely the business plan of the pay day lending industry. Here’s how it works. The “mark” (victim of the scam), desperate for money to tide her over until pay day (most borrowers are women) takes out a small loan — $350 on average — and agrees to pay the whole amount —interest, fees and principal in two weeks. If she can’t come up with the whole amount in time, she and 80% of her fellow borrowers will do the next best thing and roll the original loan over another month and then another month and then… Is it any wonder that most borrowers wind up paying more in fees and interest than the amount of the loan? Borrower pay on average $500 for a $350 loan — an APR of 400%. Another heart-stopping statistic—two-thirds borrow 7 or more times in a year. Repeat business translates into big profits. The pay day lending industry is no exception. In 2015, pay day lenders earned $8.7 billion dollars on interest and fees. Not bad for a $40 billion industry.

The process of separating people from money they don’t have is a devious one. Mehrsa Boradaran, a law professor and author of How the Other Half Banks, notes “One of the great ironies in modern America is that the less money you have, the more you pay to use it.” That’s precisely the business plan of the pay day lending industry. Here’s how it works. The “mark” (victim of the scam), desperate for money to tide her over until pay day (most borrowers are women) takes out a small loan — $350 on average — and agrees to pay the whole amount —interest, fees and principal in two weeks. If she can’t come up with the whole amount in time, she and 80% of her fellow borrowers will do the next best thing and roll the original loan over another month and then another month and then… Is it any wonder that most borrowers wind up paying more in fees and interest than the amount of the loan? Borrower pay on average $500 for a $350 loan — an APR of 400%. Another heart-stopping statistic—two-thirds borrow 7 or more times in a year. Repeat business translates into big profits. The pay day lending industry is no exception. In 2015, pay day lenders earned $8.7 billion dollars on interest and fees. Not bad for a $40 billion industry.

There you have it. Poor people in America face challenges and difficulties from all quarters. Ironically, as abused children cling to their abusers, 86% of pay day borrowers in a recent poll found the lending services of the pay day industry “useful.” That’s classic desperation. outlaw pay day lenders and their customer may face homelessness, utility shutoffs, and a host of other discomforts in what is already a pretty uncomfortable existence.

Is reform possible without pulling the rug out from under people who are just barely getting by? The CFPB trotted out their solution with a small disclaimer “We recognize that consumers may need to borrow money…that some lenders serving this market are committed to making loans that consumers can afford to pay.” Consumer advocates, how say you? “The CFPB’s …proposal misses the mark…The new rules provide more paperwork for the same 400% APR loan. That’s not consumer protection.” (Pew Charitable Trusts, Small Dollar Loan Project) “…The rule contains significant loopholes that leave borrowers at risk.” (Michael Collins, Center for Responsible Lending)

One thing is clear — for poor, minority, less educated people there are no lenders “making loans that consumers can afford to pay.” The banks abdicated their responsibility by closing most of their branches in poor neighborhoods, the credit card companies reject their applications for credit. The only industry holding out the welcome sign? Pay day lenders. CFPB reforms nibble away at the edges, never focusing on the real “down and dirty” like the ridiculously short pay-back period coupled with the lack of affordable installment payments. Most important of all, CFPB “reforms” don’t touch on the sky-high interest rates (the feds turn a blind eye to excessive interest rates preferring to let the states handle it). A fine kettle of fish when you consider that the rapid uptick in interest rates dates back to 1999 with President “I feel your pain” Bill Clinton’s push to further enrich major contributors by removing most government restrictions on the banking and finance industry (in the form of massive deregulation). That in turn emboldened state legislatures to remove their restrictions on ruinously high interest rates.

One thing is clear — for poor, minority, less educated people there are no lenders “making loans that consumers can afford to pay.” The banks abdicated their responsibility by closing most of their branches in poor neighborhoods, the credit card companies reject their applications for credit. The only industry holding out the welcome sign? Pay day lenders. CFPB reforms nibble away at the edges, never focusing on the real “down and dirty” like the ridiculously short pay-back period coupled with the lack of affordable installment payments. Most important of all, CFPB “reforms” don’t touch on the sky-high interest rates (the feds turn a blind eye to excessive interest rates preferring to let the states handle it). A fine kettle of fish when you consider that the rapid uptick in interest rates dates back to 1999 with President “I feel your pain” Bill Clinton’s push to further enrich major contributors by removing most government restrictions on the banking and finance industry (in the form of massive deregulation). That in turn emboldened state legislatures to remove their restrictions on ruinously high interest rates.

It didn’t stop there. The parade of democrats feeling your pain led to President Obama’s policy: “speak loudly and carry a very small stick.” Slipping into his “people ought to know better mode,” he pontificated “While pay day loans might seem like easy money, folks often end up trapped in a cycle of debt. (According to Noam Chomsky, watch out for politicians who refer to “folks.” They’re usually lying) His concern was not of a nature to produce any legislation to address this outrage. As we noted earlier, the “party of the people” has surrendered lock, stock, and barrel to its major funders. In the House of Representatives, as noted earlier, one democratic representative has climbed abroad the Republican express to delay even the tepid CFPB reform for at least two years. This crop of democrats dare not turn a blind eye to the demands of major contributors.

The most workable solution at this point—one that guarantees financial inclusion regardless of wealth or influence —has been around since 1911. Postal banking answers the needs of low-income Americans for banking and financial services at neighborhood post offices. In fact, postal banking, a staple in most of the highly developed countries of the world, existed in the U.S. from 1911-1966. U.S. postal banking deposits helped fund two world wars and fill depleted government coffers after the great depression. It was the public option for people who either distrusted or didn’t have enough money for the banking system. Like the proposed public option in health care, the postal banking public option was defeated by the heavy hand of elites whose profits depended on a choice-free public. President Johnson, in the tradition of democrats who preceded and succeeded him, finally succumbed to the demands of many of his major contributors. and in 1966, using the excuse of streamlining the federal government, he abolished postal banking.

Today, the advantage the banking industry once had —high interest rates —has disappeared. It’s time to consider if the system that worked so well for low-income people in the past could do so again. The United States Postal Service (USPS) would be able to offer all the bells and whistles of banks —money transfers, ATMs, debit cards, small loans (unaccompanied by hefty fees) —with little or no hassle.

In 2015, 43 million Americans met the U.S. government’s definition of “poor,” ($24,251 annual income for a family of four). A more reasonable standard, one which kept up with the inflation in housing, food, and transportation, would double or possibly triple the number of those living below the poverty line. It’s time to end the pillaging and rape of the most vulnerable by unscrupulous pay day lenders. A recent poll found that two-thirds of Americans have a negative opinion of pay day lenders and overwhelmingly describe them as predators not resources.

In 2015, 43 million Americans met the U.S. government’s definition of “poor,” ($24,251 annual income for a family of four). A more reasonable standard, one which kept up with the inflation in housing, food, and transportation, would double or possibly triple the number of those living below the poverty line. It’s time to end the pillaging and rape of the most vulnerable by unscrupulous pay day lenders. A recent poll found that two-thirds of Americans have a negative opinion of pay day lenders and overwhelmingly describe them as predators not resources.

In the best tradition of Washington pols, what the American public wants takes a back seat to what keeps big-time donors on the hook. In the age of Trump, pay day lenders will flourish. What is a surprise, but shouldn’t be is that democrats are stepping up to the plate to help them.

Politicians, pay day lenders and pirates —now we know what they have in common —fleecing the unwary, operating where no regulation can touch them, and savoring the impunity their power grants them.

1,450 total views, 1 views today