Just another day in the (self-described) richest country in the world. Forty-three million mostly young people with federal student loans (forty-five million in all if you add the ones with private loans) being hounded by their own government to pony up payments on the $1.7 trillion that bought at least two-thirds of them a college degree (the other third still have horrendous debts and nothing to show for it). To give you some idea of how immense that total is, it is equal to the entire economies of Brazil or Argentina [New York Times, 8/6/2022]. Actually total student indebtedness is $1.9 trillion with another $2 trillion sitting on the books of private financial institutions, in the form of credit card debt and loans taken out by mom and dad. Into this maw of indebtedness, President Biden proposes to cancel a tiny slice, $300 billion. What a guy!

Do we need well-educated future leaders and citizens? Here’s one statistic that might give you pause: over one-half of Americans (54%) between the ages of 16-74 read below the sixth-grade level. A country populated by a majority of semi-literate adults is bound to have trouble keeping its competitive edge over other advanced economies where college is free or affordable. Another consequence of skyrocketing debt has been its impact on college enrollment. Which, since the spring of 2020, has fallen over 7%. During that time, 1.6 million high school students have turned their backs on college. Many of them see the handwriting on the wall —two or three decades of indentured servitude for the “crime” of wanting to become an educated citizen.

Knowing that we no longer have a thriving educational system and its ramifications, why does American public opinion remain so divided on relieving the financial burden of so many of its young people? Are they listening to the talking heads on Fox News or to a lesser extent on MSNBC and CNN? Just over half (55%) of Americans support the Biden administration’s means-tested cancellation of $10,000. It gets worse. Less than half (47%) support the proposal to “forgive” $50,000. It isn’t hard to imagine how the American public would vote on erasing student debt entirely.

What’s the problem?

According to the corporate democrats (that’s most of them) and all the republicans, the “princely sum of $10,000 or in special cases $20,000, for a bare twenty million of the forty-five million debtors (not even half) is “excessive,” unfair, possibly even unamerican. Here’s Senator Joe Manchin who has made a career of enriching his BFFs in the fossil fuel industry with millions of dollars of federal tax breaks, tax credits and tax giveaways— “you have to earn it.” Or one of the (self-described) good guys, a member of the senatorial democratic crime caucus, delusional Tim Ryan (D-Ohio) whose argument would be laughable if the stakes weren’t so high — “And while there’s no doubt that a college education should be about opening opportunities, waiving debt for those already on a trajectory to financial security sends the wrong message.”

What you’re seeing and hearing are excuses not reasons to keep student debt alive and well. Remember we’re only talking about a measly ten grand cancellation with major limitations. No matter, in an empire where 536 lawmakers (including the president) spend most of their waking hours catering to the demands of their rich donors, debt forgiveness for the peons is out of the question. Let’s look at it from the lens of the oligarchs, a powerful financial cabal of bankers and corporate titans and the politicians beholden to them who are the real movers and shakers when it comes to making economic policy. What keeps them up at night is the specter of student debt cancellation sparking a whole round of “conspiratorial” thinking that it’s time to take a hard a look at all the debt making paupers out of ordinary Americans. Good lord what if there were a peoples’ crusade to cancel exorbitant interest payments on credit card debt!

Of course not all debt is created equal in the skewed eyes of the gangsters running the U.S. economy. Take that sinecure for the rich during the COVID hysteria called the Payroll Protection Plan which was sold to the public as a government effort to help preserve small businesses and their employees by loaning them money to stay afloat. To no one’s surprise the program was waylaid by the rich and powerful. Over $1 trillion of taxpayer money was distributed to corporate and financial heavyweights. Needy probably doesn’t describe PPP beneficiary Tom Brady whose net worth is $350 million and who received $960,000 in PPP loans which were subsequently forgiven (with interest). Another candidate for the bread lines, Reese Witherspoon, net worth $400 million, received a $ 1.7 million PPP loan and promptly had the whole amount (plus interest) forgiven. Remember Jared Kushner, President Trump’s son-in-law worth $800 million? He hopped on the gravy train to the tune of $5 million. If you guessed he didn’t have to pay it back, you would get an A in government ethics class.

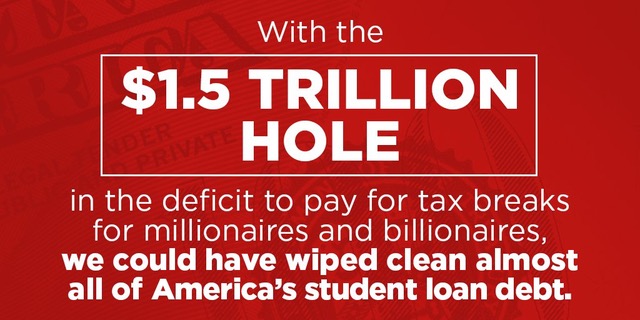

To puncture the fairy tale promulgated by both the Republicans (no surprise) and the now ex-Party of the People, the Democrats, that even a measly ten grand per “qualifying” debtor and twenty grand for an even smaller group is a big hit on the deficit, let’s start with the income the government will be receiving by the resumption of student loan payments. President Biden has announced that ending the moratorium in January will add $50 billion each year to the treasury, a total of $500 billion over ten years. The cost of the proposed forgiveness —$32 billion yearly, a total of $320 billion over the same ten-year term. Rather than bust the budget, Biden’s half-hearted attempt to relieve the burden on debt-strapped Americans will cost about $32 billion per year, while still bringing in $50 billion leaving the deficit reduced $18 billion or $180 billion over ten years. The same cannot be said for the misnamed Inflation Reduction Act that will add $500 billion to the deficit over ten years, much of it going into corporate coffers for mostly phony climate fixes and spending on infrastructure improvement that per usual will probably enrich the investors of one or more corporations and have zero effect on the economy. As usual the wooly-headed bureaucrats at the Congressional Budget Office are predicting that once the smoke clears the deficit will be reduced by $238 billion. No such rosy predictions accompany the $64 billion dollars earmarked for Ukraine, more than half of which is going to America’s defense hoodlums, the likes of Raytheon and Boeing and the other half going into the wallets of the Ukrainian oligarchs in this second most corrupt country in Europe [according to Transparency International]

Turns out that the two reasons — effect on inflation and the deficit —for rejecting even the most minimal improvement in the debt-scarred lives of student debtors are right up there with that other grand delusion — tax cuts to businesses create jobs.

Student debt is a blight on the American dream. It keeps millions of American young people currently and millions more in the future mired in debt sure to diminish their lives permanently. Watershed decisions like getting married and starting a family will probably be put on hold. Having to juggle two or even three jobs to make their monthly debt payment will take the joy out of young adulthood, shrinking their world to a brutal struggle for economic survival.

Just what you would expect from a country run by oligarchs looking to profit off the misery of other peoples’ children.