Let’s say you’re a high school senior looking forward to beginning your college career.

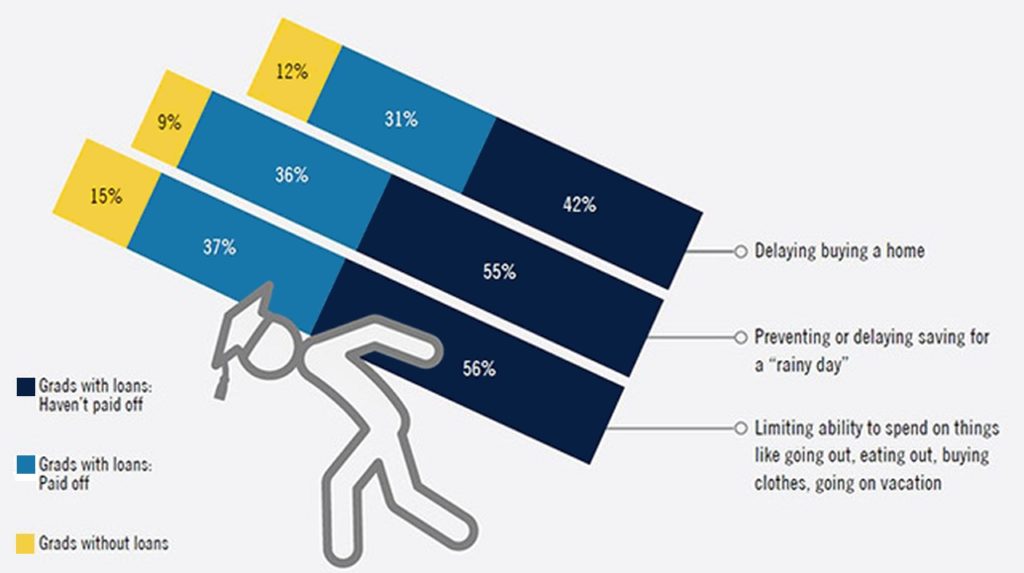

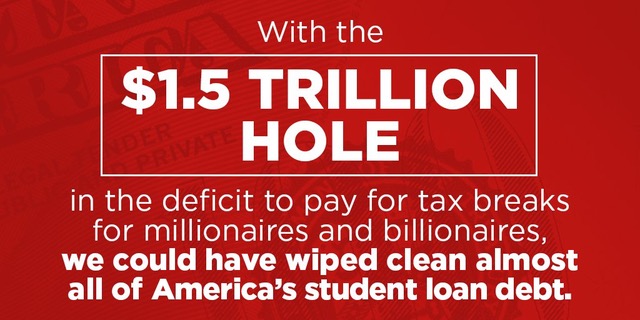

Warning: the caution lights are flashing red. The American post-secondary education system is in shambles extracting what often turns out to be a lifetime of indentured servitude for more than half (55%) of bachelor’s degree recipients (2020). Don’t believe me? At this very moment, 15% of all American adults report they still have outstanding undergraduate student debt. Student loans now outpace auto loans by close to half a trillion dollars ($412 billion). In fact, student loan debt is second only to mortgage debt. Why so much debt? It’s not just our own government, add in the private sector, the financial community getting rich off the misery of young Americans and then there’s rapacious colleges both public and private. Over the past twenty years the average tuition at public colleges and universities has risen 144%, many times greater than the rate of inflation. The easy availability of student loans has sparked a veritable gold rush— college presidents being paid like corporate CEOs, senior administrators living high off the hog, expensive vanity building projects, and football and basketball coaches making off with multi-million-dollar salaries. Like the football coach at the University of Alabama who will make $10 million this year. The worst obscenity of all — forgiving student debt won’t cost the average American one cent in extra taxes. The same can’t be said for the $64 billion dollars going to Ukraine, most of which will land in the coffers of U.S. defense contractors and Ukraine oligarchs. Don’t think students deserve a debt jubilee? Read Now You See It, Now You Don’t: The Biden Student Debt Forgiveness Scam and maybe you’ll change your mind.

447 total views, no views today