Who among us has not been affected (many personally) by the spectacle of forty-five million students carrying a collective $1.5 trillion of debt, second only to mortgage debt. Deluded by all the bleating about the necessity of a college degree, many young people are blindsided into borrowing much more than they could ever hope to pay off. For the umpty-umpth time let’s rehash the dreary statistics that stunt the lives of students mired in debt.

Today, one in four (25%) American adults are paying off student loans. Seventy percent of college students finance their education with student loans. (CNBC) You’ve heard about the golden years when Americans in their sixties retire and live off their nest eggs? For today’s graduates, the golden years will be on hold until most of them have reached the ripe old age of 75. (Nerd Wallet)

Regardless of how dire the future looks, the present is no walk in the park. As the price of a college education has ballooned in the last thirty years — 213% at public colleges and 122% at private colleges (adjusted for inflation), monthly repayments have also skyrocketed from a barely affordable $227 per month to an absolutely unaffordable $393. Another case of the financial sector getting away with highway robbery.

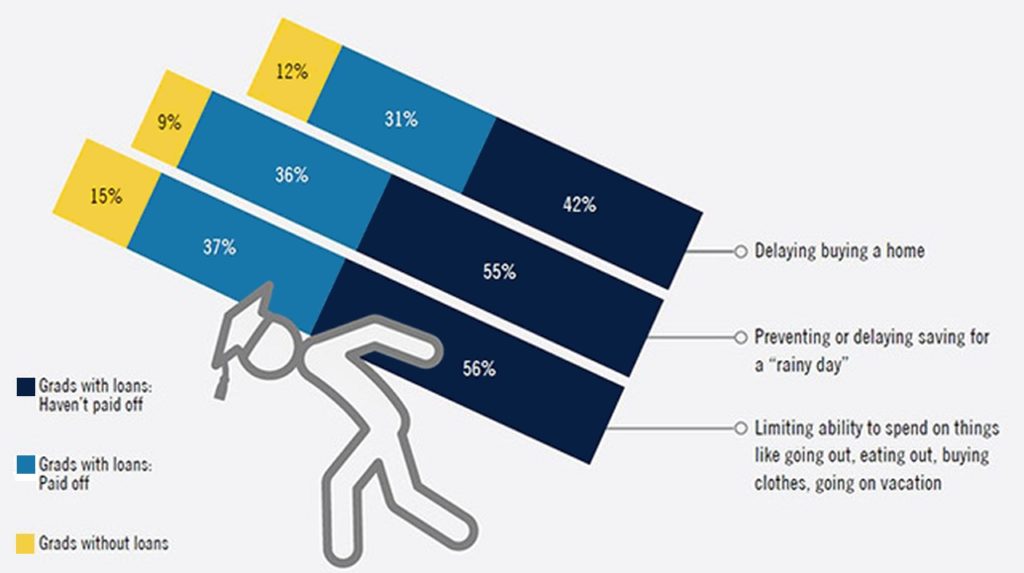

We all have skin in this terrible game. Saddled with loans carrying interest rates ranging from 4.5% to almost 10%, 25% of millennials (18-35) are forced to return to their parents’ homes after college. “[Between 2005-2014] increases in student loan debt are an important factor in explaining [millennials] lowered homeownership rates… a little over 20 percent of the overall decline in homeownership among the young can be attributed to the rise in student loan debt. This represents over 400,000 young individuals who would have owned a home in 2014 had it not been for the rise in debt.” (Federal Reserve, 2019 study). For once, the unabashedly conservative Forbes agreed “No matter how many possible solutions are tossed around Washington and beyond on reducing the crushing burden of student loan debt, it remains one of the top reasons millennials are putting off buying a home.” (Forbes, 2019)

For almost half of millennials (45%), student loans are keeping them poor. Over the past thirty years their net worth has plunged one-third (34%). This necessitates painful life style choices— delaying marriage and putting off starting a family. What a difference a couple of decades makes. In 1990 only 26% of Americans under the age of 65 were unmarried; in 2018 over one-third (36%) are. Even those who do get married wait six years longer than their peers did in 1990.

If they do marry, can they afford their first home as past generations have? One-half of student loan borrowers are unable to get approved for a mortgage. Many find it tough to get credit for any major purchase. Student debt lowers an individual’s credit score making even the rental market problematic.

Students may be the losers, but like every other capitalist enterprise, there are plenty of winners. U.S. colleges sporting multi-million dollar endowments and owning choice real estate in cities across the U.S. (Yale University owns 340 acres of prime real estate in downtown New Haven, CT.) are among the biggest winners. How have they amassed these gigantic fortunes? Big donors giving ridiculous sums of money to get their name on a building or their children admitted are important to the growing wealth of a college. But the real windfall is hidden in the U.S. tax code — total tax exemption from local, state and federal taxes for these institutions. That allows colleges and universities throughout the U.S. a free ride on roads and bridges, free use of fire and police services, public schools and parks and recreational areas. The rationale for the government’s largesse toward these schools was originally in the form of a quid pro quo —lifting the tax burden in return for public service commitments to local communities.

Shortly after the deal was struck, the reciprocity aspect disappeared. The irony is that long before there was a U.S. government, the colonial settlers themselves set up “voluntary associations” and didn’t need a tax dodge to make them work in the interests of the community. As early as 1831 a visitor to America, Alexis de Tocqueville, commented on America’s ability to use “voluntary associations” to benefit the people — “Americans of all ages, conditions, and dispositions constantly unite together…Americans group together to hold fetes, found seminaries, build inns, construct churches, distribute books… I have frequently admired the endless skill with which the inhabitants of the United States manage to set a common aim to the efforts of a great number of men and to persuade them to pursue it voluntarily”

In 1913 when the sixteenth amendment gave Congress power to create an income tax, the voluntary associations were still considered community assets. On that basis, Congress decided to make them exempt from the taxes needed to run the country.

Fast forwarding to today, let’s see what the generosity of the American people toward one sector of the non-profit world —colleges and universities — has wrought. In a 2015 editorial, the New York Times observed that Yale University had paid close to one-half billion dollars to hedge funds to manage their endowment. Want to take a guess on how munificently Yale contributed to tuition assistance and fellowship grants to students in the same year? A measly $170 million, one-third of the amount they spent enriching their cronies in the shadow banking world. This disparity in funding is particularly unconscionable as the average cost to attend both public and private colleges has risen at an alarming rate over the last thirty years. While inflation (as measured by the consumer price index) was rising 77%, college costs were escalating at an alarming rate — among private colleges over 200%. A case of unmitigated greed —particularly in light of the fact that colleges have managed to replace over 50% of tenure-track professors with “adjuncts” whose measly salaries save these institutions millions.

Is it any wonder that students from the top 1% of households are 77 times more likely to be admitted to an Ivy League school than students from families who make less than $30,000 a year? (Study by Harvard economic professor Raj Chetty). As this report from Equality of Opportunity Project points out — “The elite universities including Princeton and Yale admit more students from the top 1% of earners in America than from the bottom 60% combined.”

More evidence that the highest-ranking institutions in the U.S. have become the property of the sons and daughter of oligarchs— the median family income of Yale students is $192,600, 69% come from the top 20% of wealthy families and 19% are from super-wealthy families (top 1%). Most students in the bottom 60% of the wealth scale will never see the inside of an elite institution, but will nonetheless have to pony up the additional taxes these schools do not have to pay.

Radical changes are in order. For the privilege of a free ride and as the number of lifetime debtors rises with every graduating class, colleges and universities must be required to spend more on tuition assistance and less on enriching their bloated endowments. Why shouldn’t Yale, for example, turn the half billion dollars they spend to oversee their $29 billion endowment into a fund to address the needs of qualified students whose fathers and mothers are not plutocrats.

At a time when 58% of Americans favor free college tuition and cancellation of all student debt, the voters have every right to demand a leader who will get the job done.

Imagine a world where the richest country and sole superpower issued to every child born in the U.S., a certificate guaranteeing free education from kindergarten to college and for the most ambitious, graduate school. With a public committed to change and willing to raise their voices, it can and will get done. Let’s start by ending the free ride U.S. colleges and universities have profited by for over one hundred years.

579 total views, 2 views today